Estate Planning Attorney Fundamentals Explained

Table of ContentsNot known Incorrect Statements About Estate Planning Attorney An Unbiased View of Estate Planning AttorneyEstate Planning Attorney Things To Know Before You BuyThe 5-Minute Rule for Estate Planning Attorney

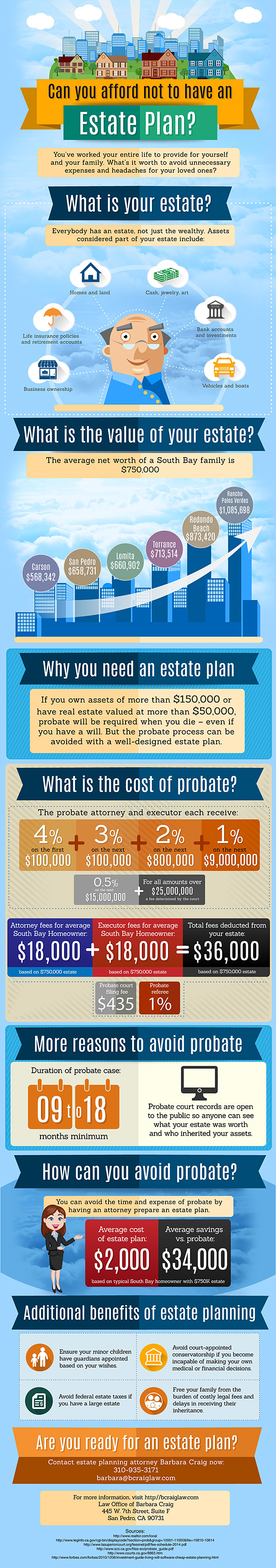

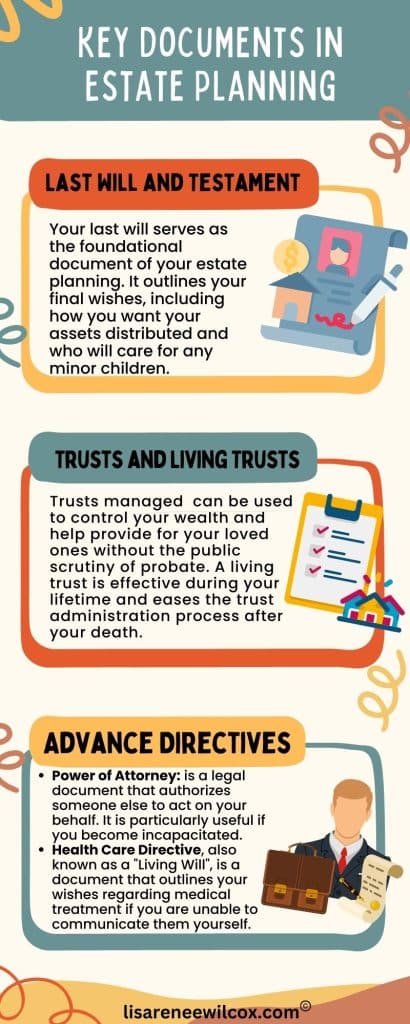

Estate planning is an action plan you can utilize to establish what happens to your assets and responsibilities while you live and after you die. A will, on the other hand, is a legal paper that outlines how possessions are dispersed, that looks after youngsters and pets, and any other desires after you pass away.

The executor additionally has to repay any tax obligations and debt owed by the deceased from the estate. Financial institutions typically have a minimal amount of time from the day they were informed of the testator's fatality to make cases versus the estate for money owed to them. Claims that are turned down by the administrator can be taken to court where a probate court will certainly have the last word as to whether the insurance claim is legitimate.

The Buzz on Estate Planning Attorney

After the stock of the estate has been taken, the value of possessions computed, and tax obligations and financial debt repaid, the administrator will certainly after that look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any type of inheritance tax that are pending will come due within nine months of the date of death.

Each individual places their assets in the trust and names someone other than their partner as the recipient., to sustain grandchildrens' education and learning.

Excitement About Estate Planning Attorney

Estate organizers can work with the donor in order to lower taxable income as an outcome of those contributions or create methods that maximize the result of those donations. This is an additional method that can be used to restrict death tax obligations. It includes an individual securing the current worth, and thus tax obligation obligation, of their home, while attributing the worth of future development of that funding to another person. This approach includes cold the value of a property at its value on the day of transfer. Accordingly, the quantity of potential funding gain at death is likewise frozen, permitting the estate planner to approximate their prospective tax obligation obligation upon fatality and far better plan for the repayment of revenue taxes.

If adequate insurance earnings are readily available and the plans are correctly structured, any kind of revenue tax on the considered personalities of properties following the death of a person can be paid without considering the sale of assets. Proceeds from life insurance coverage that are obtained by the recipients upon the death of the insured are typically earnings tax-free.

There are i thought about this particular records you'll require as component of the estate preparation procedure. Some of the most usual ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is only for high-net-worth people. Estate intending makes it much easier for individuals to determine their wishes prior to and after they pass away.

All about Estate Planning Attorney

You must begin planning for your estate as quickly as you have any measurable property base. It's a recurring procedure: as life advances, your estate plan must change to match your situations, in line with your brand-new goals.

Estate planning is typically believed of as a device for the wealthy. Estate planning is likewise an excellent means for you to lay out strategies for the treatment of your small kids and family pets and to detail your dreams for your funeral service and favorite charities.

Qualified applicants that pass the test will be officially licensed in August. If you're eligible to sit for the examination from a previous application, you might file the brief application.